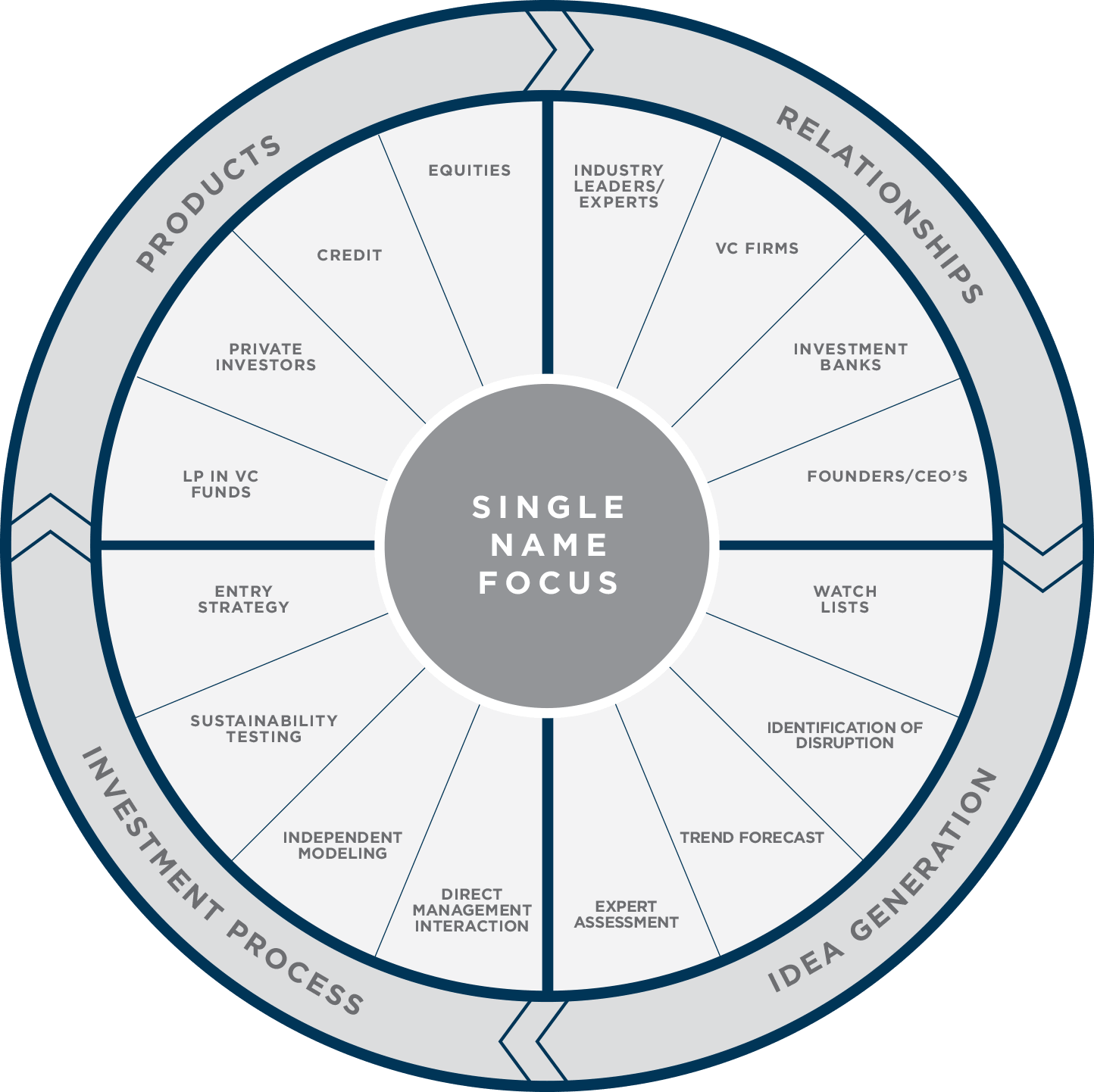

Irving was founded in 2009 as a dedicated equity fund focused on disruptive technology and high growth opportunities, and has since expanded into Credit and Private investments.

The fund looks to form meaningful relationships with companies by offering its capital, expertise, and connections to promote growth and return on investment.

Irving has been involved in several successful private exits and is a trusted advisor and LP in Venture Capital funds.

The firm has offices in New York and Colorado.